This blog is for discussions on all aspects of insurances, that will help you as a customer to create the revolution of insurances.

The insurances and the customer

When a business area starts stagnating in a market area, it shows signs that a change is needed. Insurance business is growing in Asia, South America, but in North America and Europe the premium growth has been more or less on the same level than before for the past years (McKinsey, 2017). This means that the insurance will need to renew itself to still be relevant in the eyes of the consumer.

Where are we heading

There are number of areas where the business needs to consider what to do differently. We all want to avoid the feeling of not having customers and that and that our customer won’t feel like being in a silent disco as in the picture below. As if they feel left alone by their insurer or they feel being the only one still having insurances, in both cases, there will be a downfall ahead.

Me, the consumer

Insuring in general, gives a majority of us a headache or at least a feeling of discomfort. These feelings bring us to one of the basic question of us as individuals, customers, humans and members of society, if we don´t understand the topic, it makes us feel uncomfortable. Most of us can claim to say understanding the basis of insurances and the principle that we want to share the risk among our peers is valid even in our time. After this principle we can argue that it gets more complicated.

How many of us can say which insurances we have to have? There are number of insurances that are required by law, governing bodies, landlords, financing, etc. and these insurances are still something we can relate having as customers and members of the society. Then there are numerous of insurances that we can have as an addition to almost whatever situation we can imagine.

The difficulty is that we as customers don’t know which insurances to have and the insurance companies don’t know how to launch new products which would either replace the old ones or be completely new ways of insuring.

Yellow May Ltd.

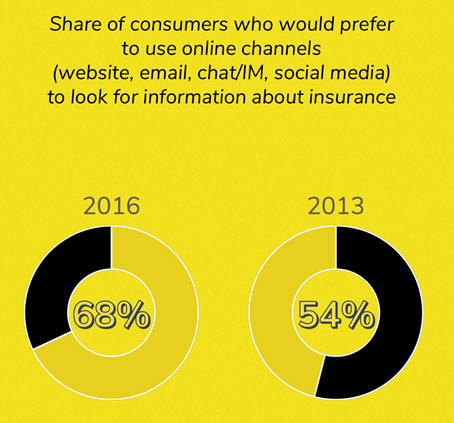

Why did we wanted to create a company with the ambition to create revolution of insurances? When we combine the customer´s requirements and the mix of insurances, this is what we found from Accenture:

Source of data:

Accenture financial services 2017 global distribution & marketing consumer study: insurance report

This will require a new kind of approach from the buyers, but foremost a new way of looking the future customer of the insurer. This is need something that we identidied, how it should feel in the future for the buyer of insurances. Someone might argue that the change would need to start somewhere else than buying, but we feel that the customer has to be returned to the centre of the insurance ecosystem. We consider the best way to do this is to change the approach how we can buy insurances in the future.

This is what we will launch. Aiming to meet halfway the customer and the old and the new insurers. The key for me as a customer of the insurance companies was that I want to use the solution and as we did not find it offered by anyone, so we aim to create it.

What if buying insurances would be easy, fun and transparent? By easy, we mean that you can do it from various sources at the same time and you will get a suggestion for your coverages. By fun, we mean that it should be effortless to buy, but also get your quote almost instantly. Delivering transparency, we mean that you will be able to compare the products and you can see what are you paying for. All this to avoid headache and feel that you want to compare, buy, learn and test new useful insurance products for you.

When

Sign up on our website to hear, when the revolution begins!

4 takeaways

- What do you understand from your insurances?

- How do you know that you have relevant insurances?

- Do you know the insurance customer of the future?

- Revolution of insurances starts from you

Author: Jussi Tommola, Yellow May Ltd.